By Janhit Gyan Team

Published on 23 December 2025

Aadhaar PAN Card Link 2025: Kyun Zaroori Hai? Deadline Ke Baare Mein Sab Kuch

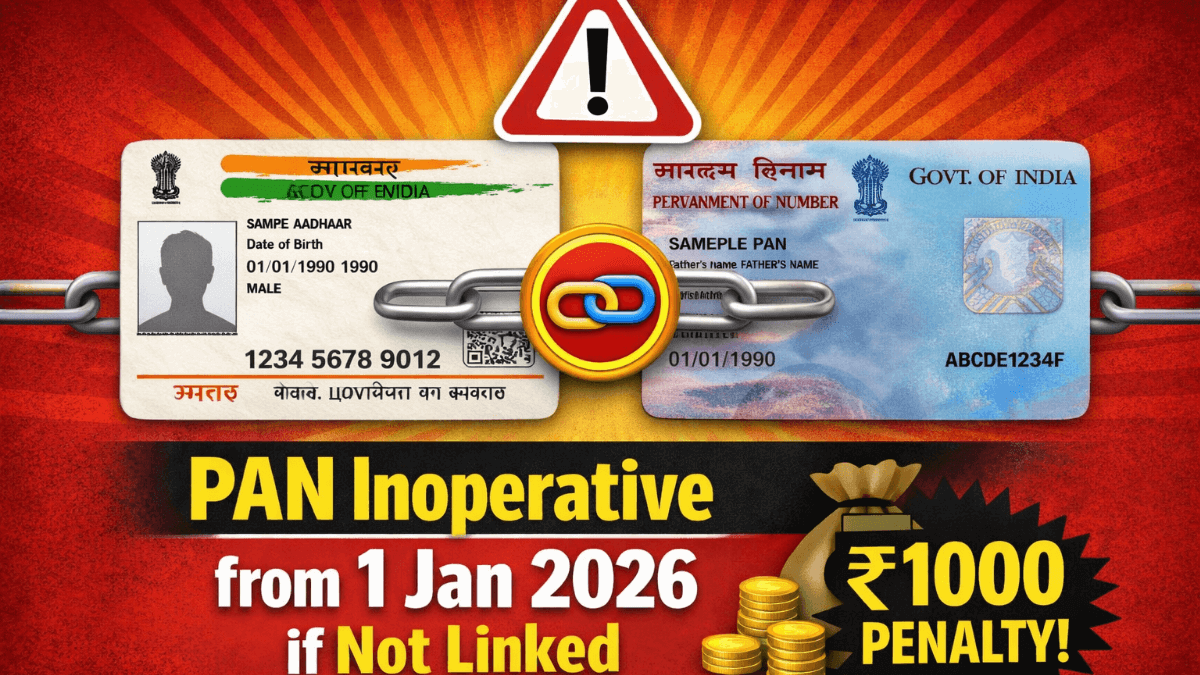

Aadhaar PAN Card Link 2025: Income Tax Department ne clear kar diya hai ki 31 December 2025 tak har eligible person ko apna PAN card Aadhaar se link karna hai. Agar nahi kiya, to 1 January 2026 se PAN inoperative ho jayega – matlab wo use nahi kar paoge tax filing, banking ya high-value transactions ke liye.

Ye rule specially un logon ke liye hai jinhone 1 October 2024 se pehle Aadhaar enrolment ID se PAN banwaya tha. Baaki sab ke liye pehle se mandatory tha, lekin ab final deadline sabke liye ye hai. Government ka maqsad fake PAN rokna aur tax system clean karna hai.

Mujhe lagta hai, bohot log last minute tak wait karte hain, lekin portal par rush hone se problem ho sakti hai – abhi kar lo.

Aadhaar PAN Card Link 2025: Nahi Linked To Kya Penalty Aur Problems Hongi?

Aadhaar PAN Card Link 2025: Agar deadline miss kar di:

- PAN inoperative ho jayega – ITR file nahi kar paoge, refund ruk jayega.

- Higher TDS/TCS: Transactions par zyada tax kat jayega.

- Banking issues: New account, high-value deals mein problem.

- Late linking ke liye Rs 1000 penalty lagegi (e-Pay Tax se pay karna padega).

Specific group (enrolment ID wale) abhi tak free mein link kar sakte hain, baad mein penalty compulsory.

Aadhaar PAN Card Link 2025: Kaise Karein? Step by Step Online Process

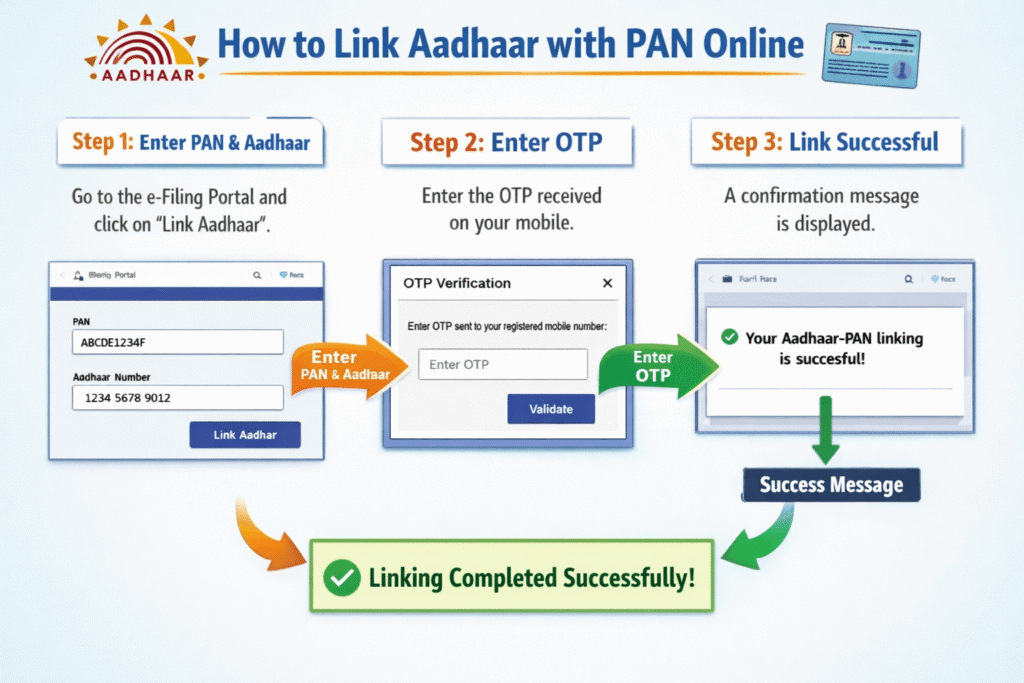

Sabse easy way Income Tax e-Filing portal se hai – free aur quick:

- 1. Website kholo: incometaxindia.gov.in ya incometax.gov.in/iec/foportal

- 2. Homepage par “Link Aadhaar” option dikhega (Quick Links mein).

- 3. PAN number aur Aadhaar number daalo.

- 4. Name aur DOB match karega (Aadhaar ke hisaab se).

- 5. Registered mobile par OTP aayega – enter kar do.

- 6. “Validate” click karo – linking complete!

Agar name/DOB mein mismatch hai, to pehle Aadhaar ya PAN update karwao (UIDAI ya Protean/UTIITSL se).

SMS se bhi kar sakte ho: Registered mobile se “UIDPAN <12-digit Aadhaar> <10-digit PAN>” type kar ke 567678 ya 56161 par send kar do.

Aadhaar PAN Card Link 2025: Linking Status Kaise Check Karein?

- Same portal par “Link Aadhaar Status” option hai – PAN daal ke check kar lo.

- Message aayega: “Linked” ya “Not Linked”.

Agar already linked hai, to tension mat lo.

Mismatched Details Kaise Fix Karein?

Agar linking fail ho raha hai name/DOB mismatch se:

- Aadhaar update: UIDAI website ya nearest centre jaake karwao.

- PAN update: Protean (formerly NSDL) ya UTIITSL se.

Biometric option bhi hai authorised centres par (extra charge).

Kon Exempt Hai Linking Se?

- Non-residents (NRIs)

- 80 saal se zyada umar wale

- Kuch states (Assam, Meghalaya, J&K ke non-citizens)

Baaki sabko karna hai.

Yaha padho: RCB FULL SQUAD 2026

Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice. Taxpayers are advised to consult a qualified tax professional or refer to the official website of the Income Tax Department for accurate and up-to-date guidance before filing their returns Janhitgyan.com does not take responsibility for any misunderstanding or loss.

Agar information achhi lagi ho to comment men bataye aur aishe information ke liye hamare site pr visite kre aur hr tarah ki update milti rahti hai thank you.

Janhitgyan.com par aise hi sarkari updates, deadlines aur guides milte rahenge. Comment mein batao – aapne link kar liya ya nahi? Abhi kar lo, safe rahega!

Credit&Source: Income Tax Department Official Website, CBDT Notifications, Times of India, The Hindu, Economic Times